Market review of Nov 29, 2024 and near term market outlook for December 2 - 6 ( S&P 500 All time high, breadth relatively high, Sentiment extremely Bullish )

Hi fellow subscribers!

Thanksgiving week has come and gone, and there's so much to be grateful for this year. It’s been a somewhat good year overall—I still managed to afford a decent holiday, and my son's hospital expenses were thankfully covered by insurance. But above all, I’m most grateful for my health. I was plagued by annoying headaches every morning throughout October and November. However, a good sleep during the vacation period seemed to have worked its magic, and the pain has disappeared. (Admittedly, those headaches were the main reason I couldn't focus enough to pen down my market review.)

Personal Reflections

It's easy to get lost in the hustle and bustle of life and forget to take a moment to breathe and reflect. My vacation provided just that—a chance to recharge and gain perspective. I was reminded of the importance of self-care and how crucial it is for our overall well-being. Sometimes, a little R&R is all you need to get back on track.

Market Review

In terms of investing and trading returns, I’m still surviving and have managed to eke out some run-of-the-mill to somewhat-good returns. Maybe I set my expectations too high, or maybe I’m just getting green-eyed seeing all those crypto bros’ returns. Nevertheless, I’ve got to stay grounded in my process. The market has been a rollercoaster, and it's taught me valuable lessons about patience and persistence.

New Framework for Investing and Trading

During the vacation, I had a bit of an epiphany and devised a new, more efficient framework to review my investment and trading process. This new approach is designed to streamline my decision-making and keep my emotions in check. You’ll get a first taste of it in this report, and I hope it provides you with some useful insights. Vacation truly works wonders and creates the perfect conditions to spark new ideas and frameworks.

Looking Ahead

As we move towards the end of the year, it's essential to reflect on our achievements and set realistic goals for the future. I’m optimistic about what lies ahead and excited to continue this journey with all of you. Let’s stay grounded, stay focused, and keep pushing forward.

Remember, it's not just about the destination, but the journey and the lessons we learn along the way. Whether it's about investing, personal growth, or life in general, let's keep striving to be better versions of ourselves. Thank you for sticking around and being part of this community, and I look forward to sharing more awesome insights and experiences with .

Stay healthy, stay grateful, and keep investing wisely!

Now, let's dive into the nitty-gritty of market review

Broad market overview

S&P 500 and Dow made a new ATH again. Equal-weighted indices, small& mid cap are outperforming recently, while Large cap tech lag causing Nasdaq 100 to underperform.

S&P 500 11 sectors overview

Financial, Industry, Discretionary, communications continue to gain ground since elections, while Healthcare underperformance is notable ( not surprising, since RFK Jr become secretary of health )

MOVE index

MOVE has been falling since Election is over. Move index is currently at 95.22, bond price implied volatility is expected to be around 9.52% per annum.

Lower MOVE points to (implied) lower bond market volatility going forward. Bond volatility moving lower translates into less haircut to bond, in which more liquidity can be extracted from the collateral pool.

Summary of Market situation

Trend and Momentum Section

SPX

NDX

Market breadth section

% of SPX stocks above 20D 50D 200D moving average

SPX made new ATH while breadth stay at relatively high level

% of SPX stock above 20D MA : 83.2%

% of SPX stock above 50Day MA : 71.0%

% of SPX stock above 200Day MA : 76.0%

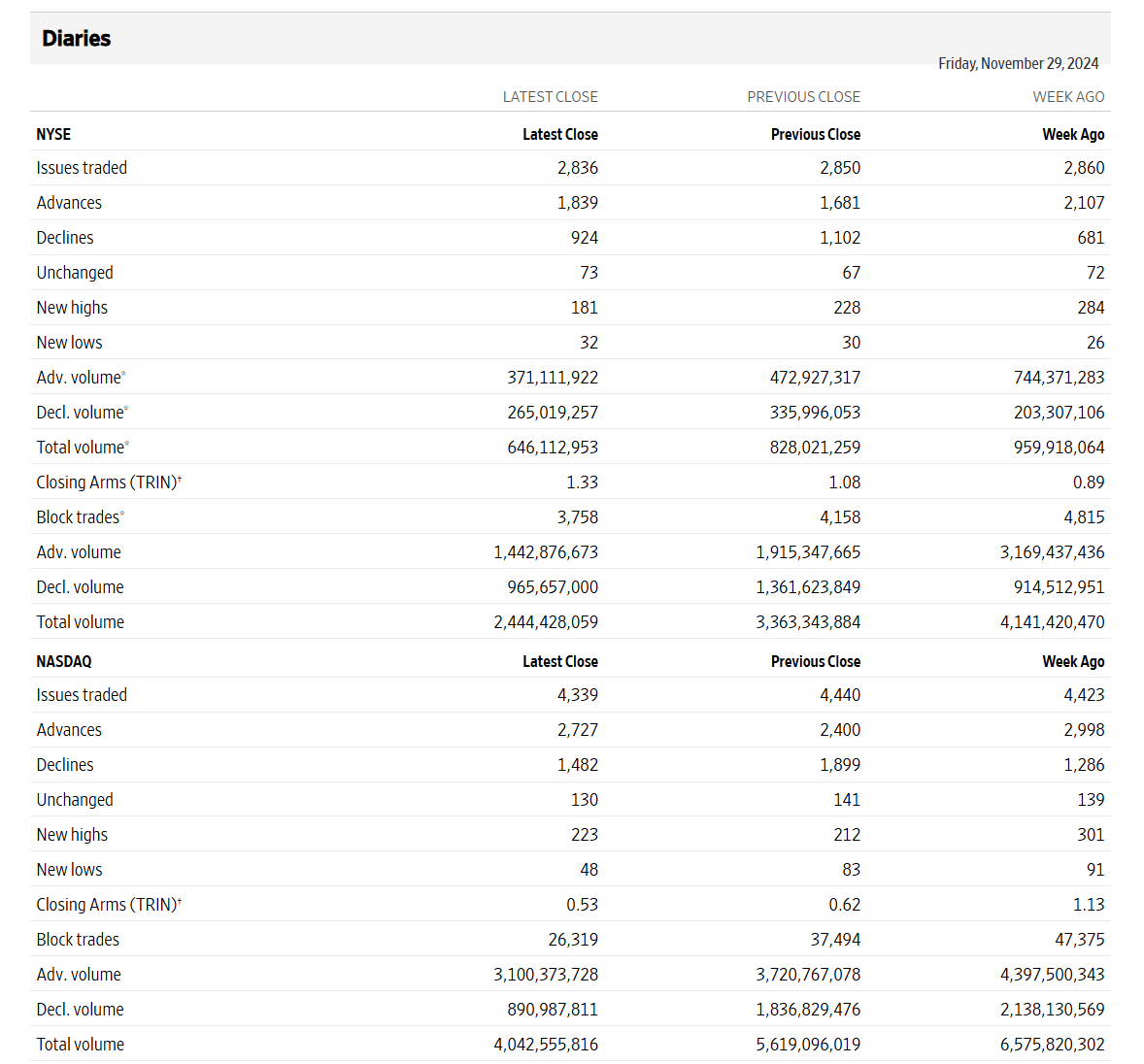

NYSE & Nasdaq market internals

There are more Advancer than Decliner.

On Nov 29 2024 shorten trading session,

1.99 to 1 NYSE Decliners to Advancer ratio (1839/924 )

1.84 to 1 Nasdaq Advancers to Decliner ratio (2727/1482 )

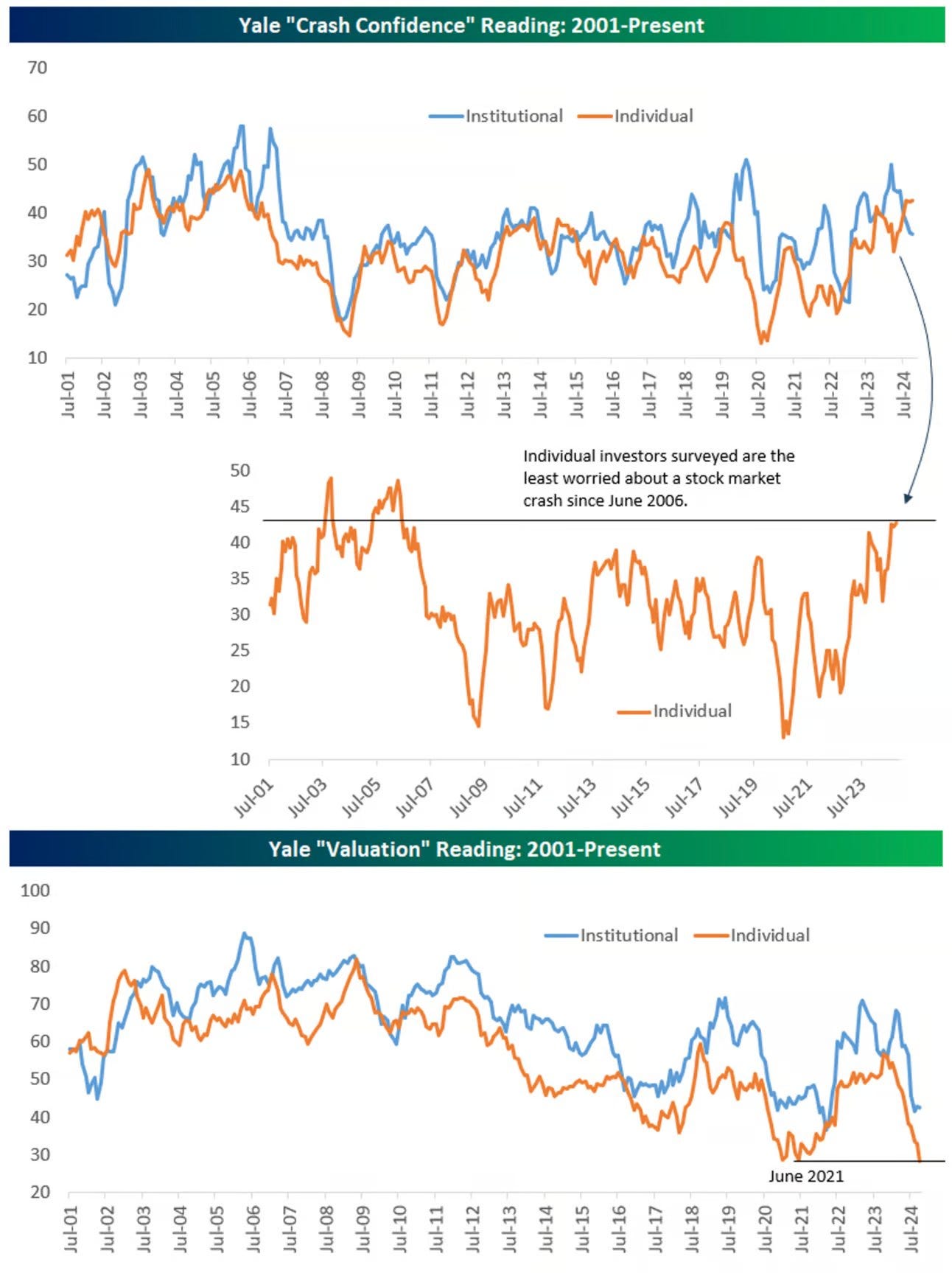

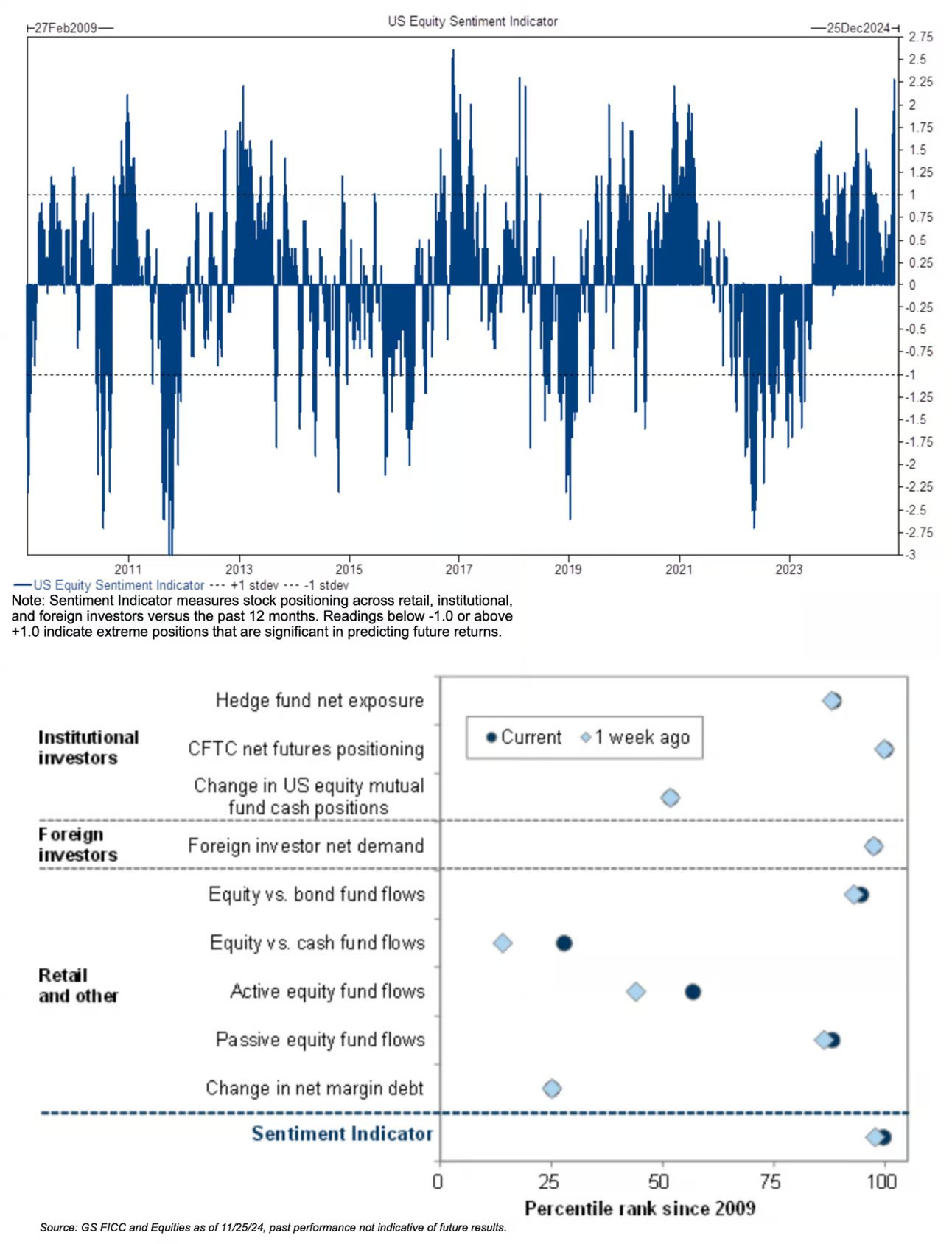

Sentiment

It’s extremely bullish, bordering on Mania on the retail side.

As for institutional side, it’s at elevated level as well. More targeted and near term review on this in the subscriber section

Positioning

Subscriber only and is pending for latest data release today, due to shorten Thanksgiving trading week.

Upcoming Economic data release

There are several high profile data coming this week as well as fed speeches. What are the expected market volatility % for each of this data release ? Unlock the expected movement info in subscribers section.

Secret sauce for subscribers section

Unlock Exclusive Insights and Secure Your Financial Future!

Are you eager to:

1. Discover near-term opportunities vs. risks and know the right actions to take for your portfolio?

2. Access the "Secret Sauce" section that strengthens the resilience of your investment process, minimizing financial and mental strain during market drawdowns?

3. Expected market movement for the upcoming economic calendar ?

If so, join my Paid Subscription and elevate your financial game!

Why Invest in Our Paid Subscription?

For just $15 per month (a mere $0.50 per day) or $149 per year (less than $0.42 per day), you’ll gain:

🔍 Expert Analysis: In-depth analysis of market trends and actionable insights to stay ahead of the curve. 📈 Big Ideas: Multiple high-impact ideas per year to capitalize on the biggest shifts in the financial market. 🔑 Secret Sauce: Proven strategies and techniques to fortify your investment process, ensuring resilience and long-term growth. 💡 Knowledge & Empowerment: Empower yourself with the knowledge to make informed decisions and accelerate the growth of your savings and investment accounts.

Cost vs. Benefit

Imagine turning your daily coffee budget into a powerful investment strategy that drives your financial success. For less than the cost of a cup of coffee, you can access expert guidance and exclusive insights that have the potential to significantly boost your portfolio's performance.

Why Choose Our Service?

· Proven Results: Our subscribers have consistently outperformed the market, thanks to our timely and insightful advice.

· Comprehensive Support: We don’t just give you the "what" but also the "how" and "why," ensuring you understand every step of your investment journey.

· Community: Join a community of like-minded individuals who are committed to achieving financial independence and success.

Join Us Today!

Don’t miss out on the opportunity to transform your financial future. Subscribe now and start making smarter, more informed investment decisions.