Daily market review July 8, 2024 ( Market pricing in disinflation path, softer CPI while pending for Fed chair Powell Semi-annual testimony and CPI data )

Broad market overview

Overall market didn’t move much on Monday, as market is pending for Powell Semi-annual testimony to Congress on Tuesday and CPI print on Thursday. On hindsight, based on the market action of the past 5 days, (cap-weighted) market has already priced in softer CPI and softer labour/economic growth post Powell disinflation narrative last Tuesday in Sintra ECB forum. Economic data bears that out as well, softer inflation, softer growth and labour market, resembling a goldilocks type of situation.

There’re still a lot skeptics out there,

1) Talk of second wave of inflation coming ( higher shipping freight cost, still too soon to price in for market )

2) Fed cut = bad things happening ( recession coming , or hard landing…etc, there’s too much government spending for the economy to fall into recession )

3) Breadth is extremely weak, market performance is driven by a few AI related stock. This is what we are watching carefully, if there’s no broadening out in times to come, then additional caution may be warranted

But we do believe that this week will be a week of reckoning as Fed chair Powell testimony and CPI will quash the first 2 narratives out there. And if you take any action by Thursday when the dust settles, it would have been too late. But what about entering market now, well not much upside to capture and risk rewards has become unfavourable. ( I hope I’m wrong, but let’s see )

S&P 500 11 sectors overview

Nothing much to see here..

MOVE index

Falling from lower high here.

Move index is currently at 97.96, ( bond price implied volatility is expected to be around 9.8% per annum. ) Lower MOVE points to (implied) lower bond market volatility going forward.

Bond volatility moving lower translates into less haircut to bond, in which more liquidity can be extracted from the collateral pool.

NYSE & Nasdaq market internals

There’s marginally more advancers than decliners

Generally after Memorial day holiday, volume will decline gradually heading into the summer season.

On July 8 2024,

1.25 to 1 NYSE Advancers to Decliners ratio (1552/1236 )

1.27 to 1 Nasdaq Decliners to Advancers ratio (2346/1842 )

% of stock above 20Day, 50Day, 200Day

Breadth stalled while SPX breakout from recent consolidation range.

breakout and improvement in breadth may possibly be coming soon, which could bring about broad based rally. Otherwise…

% of SPX stock above 20D MA : 47.8%

% of SPX stock above 50Day MA : 46.8%

% of SPX stock above 200Day MA : 65.8%

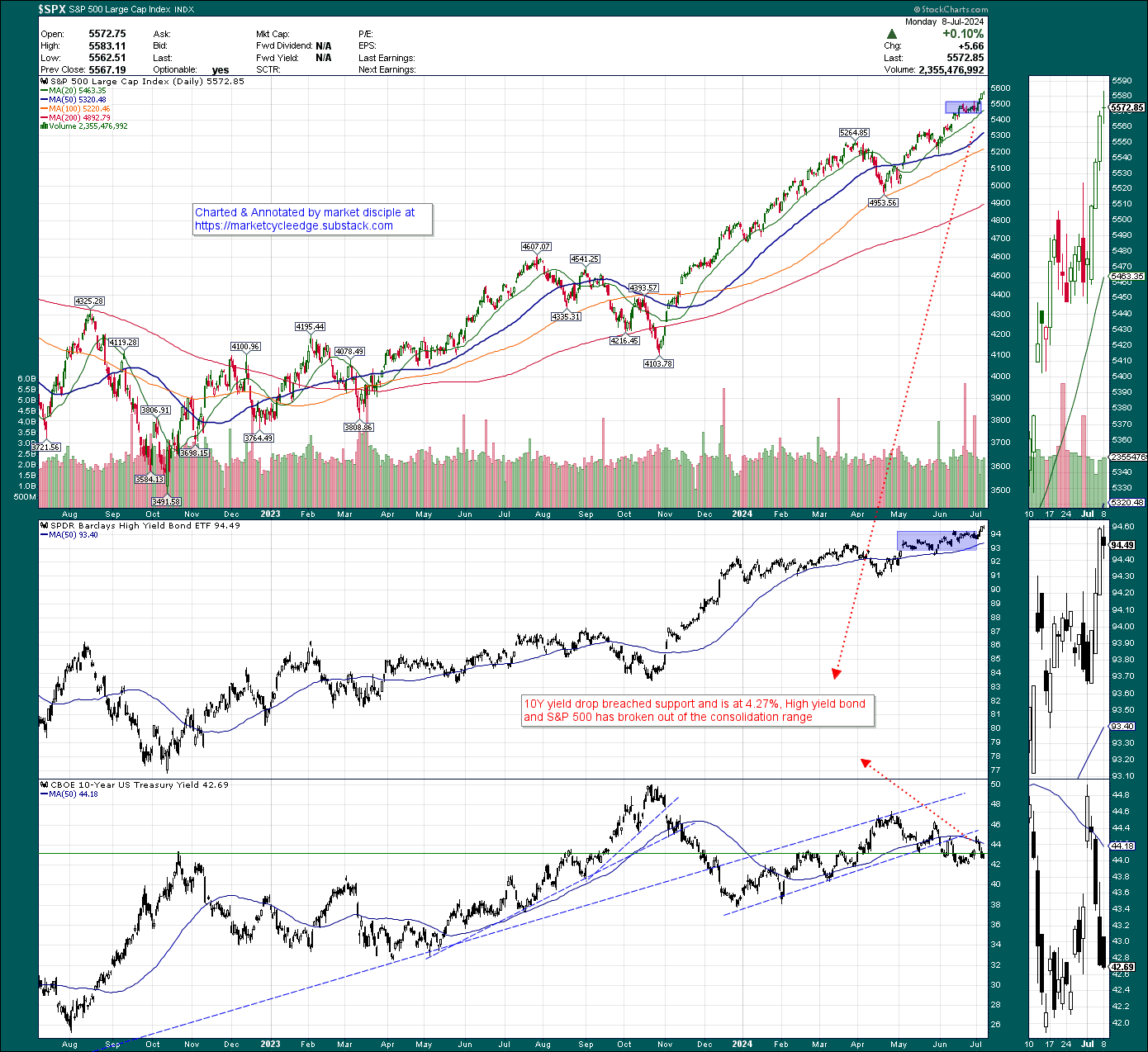

TNX and high yield bond

10Y yield drop breached support and is at 4.27%, High yield bond and S&P 500 has broken out of the consolidation range

Bitcoin

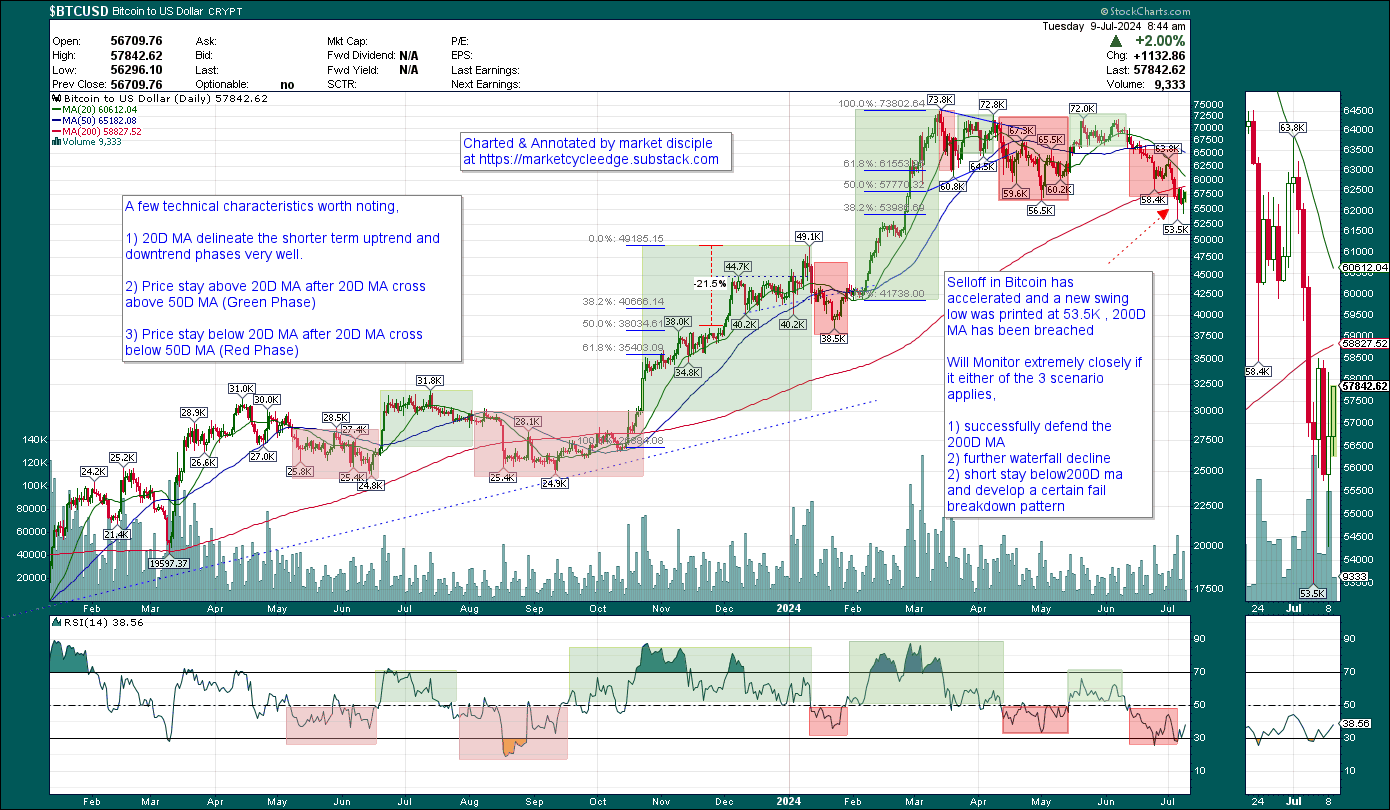

According to the foremost Global Liquidity Expert, Bitcoin track the Global Liquidity relatively closely, lagging only by about 6 weeks, it display the quickest responsiveness to changes in liquidity conditions.

Bitcoin recent function as a liquidity proxy has gone completely kaput for the past few days, this is because Bitcoin is mired in its own market idiosyncrasy, while stock market is obeying in its own cycle characteristics

Both Mt Gox and German government move their bitcoin at liquidity thin holiday period around Independence day, contributing to the sell off

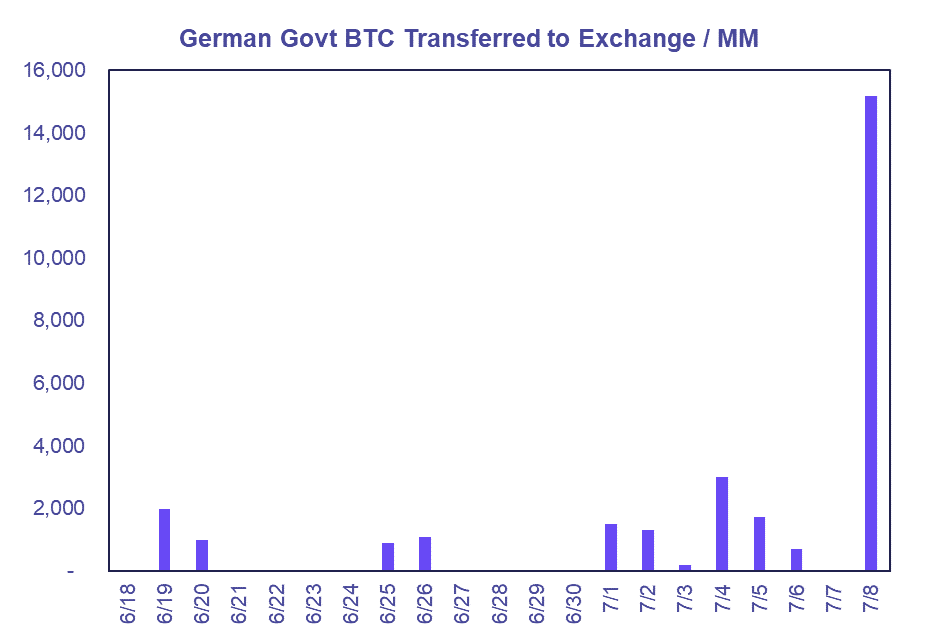

German government bitcoin movement

German government has moved tremendous amount of bitcoin to the exchange

Will it cause further sell-off or will market be able to absorb the selling qty without losing ground ?

Bitcoin daily chart

Selloff in Bitcoin has accelerated and a new swing low was printed at 53.5K , 200D MA has been breached

Will Monitor extremely closely if it either of the 3 scenario applies,

1) successfully defend the 200D MA

2) further waterfall decline

2) short stay below200D ma and develop a certain fail breakdown pattern

NDX and SPX trend line is getting steeper

Trendline is getting steeper, should you be concerned ?

When will breadth improve and kickstart a broad based rally and when should you be concerned if the market rally is still not broadening out

Join my paid subscription as I unpack and give you more contextual data to analyze if it's something we should be concern about

if you would like to know more about the risk parameters to establish high probability profitable trade, and subsequent response to next market development then join my Paid subscription

the following sections are for paid subscribers

Paid subscribers will get my thoughts on the latest update in the market as the situation/development unfolds. You will also get access to higher quality indicator ( Positioning, money flow, AVWAP, cycles ) to get a better handle on the market, and triangulate your entry point at Buying/accumulating your 401K ETF product.

Join the subscription and leave your doubt behind if you want to avoid second guessing yourself on your Investment and trading decision. In today market, you need access to evidence based research and analysis to thrive and grow your account. Otherwise, you will be left guessing, 2nd guessing yourself pose a huge cost to your money, your time and lost Opportunity cost in the market.

Quality decision making is my middle name, which allows your money to work for you in the financial market, saving you tons of time and money while you are busy attending to your work and family commitments.

So when will breadth improve and kickstart a broad based rally subsequently?