Daily market review July 11, 2024 ( Lower than expected CPI data inspire rotation into mid and small cap )

As I was scouring the internet for the thumbnail photo that would depict the theme for this market entry, I came across this interesting picture of David vs Goliath, as the picture implies the small and the medium will initiate their outperformance against Megacap as more rate cut are priced in. But how sustainable it is, will remain to be seen.

Broad market overview

Post CPI data release, leading performers such as Semiconductors, cap-weighted indices experience losses ranging from -3.64 to -0.88.

Small and mid cap had a monster rally of 3.31% and 2.45% respectively

Equal weighted indices performed better than cap-weighted indices, rotation is ongoing as the lower than expected move has finally given hope to more rate cut, sparking revival in mid and small cap.

S&P 500 11 sectors overview

Real estate, Utilities and materials are the top performing sectors, while Technology, communications and discretionary are the worst performing sectors.

MOVE index

Falling from lower high here, and has been falling for 6 consecutive session.

Move index is currently at 89.67, ( bond price implied volatility is expected to be around 8.97% per annum. ) Lower MOVE points to (implied) lower bond market volatility going forward.

Bond volatility moving lower translates into less haircut to bond, in which more liquidity can be extracted from the collateral pool.

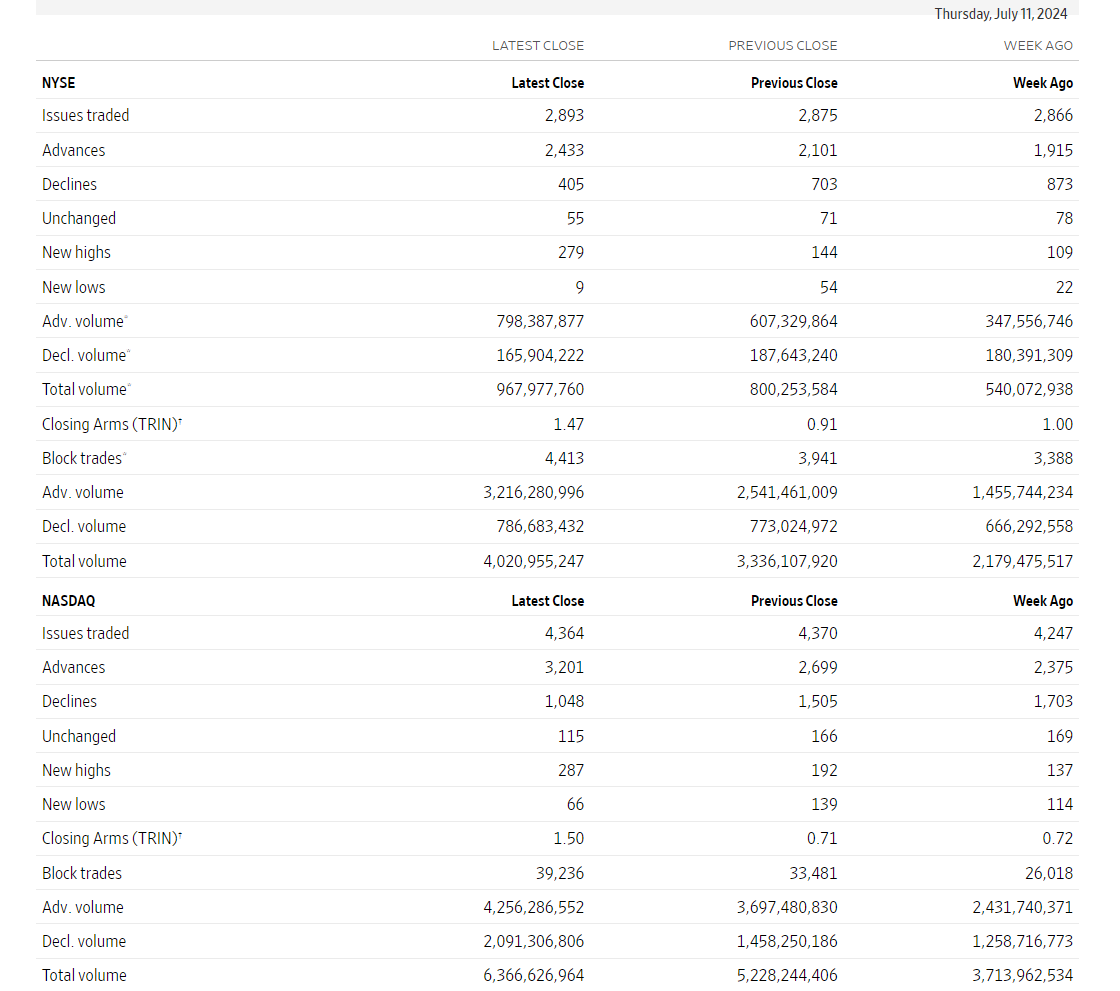

NYSE & Nasdaq market internals

There are significantly more advancers than decliners

On July 11 2024,

6 to 1 NYSE Advancers to Decliners ratio (2433/405 )

3.05 to 1 Nasdaq Advancers to Decliners ratio (3201/1048 )

% of SPX stocks above 20D 50D 200D moving average

Marked improvement in breadth and broadening of rally is coming soon, but as institutions rotate money into other sector, cap-weighted indices will experience pullback, albeit should be a healthy one

% of SPX stock above 20D MA : 75.8%

% of SPX stock above 50Day MA : 63.4%

% of SPX stock above 200Day MA : 71%

Bitcoin

According to the foremost Global Liquidity Expert, Bitcoin track the Global Liquidity relatively closely, lagging only by about 6 weeks, it display the quickest responsiveness to changes in liquidity conditions.

Bitcoin recent function as a liquidity proxy has gone completely kaput for the past few days, this is because Bitcoin is mired in its own market idiosyncrasy, while stock market is obeying in its own cycle characteristics

Both Mt Gox and German government move their bitcoin at liquidity thin holiday period around Independence day, contributing to the sell off, and we have yet to emerge from the current chaos.

Bitcoin daily chart

Selloff in Bitcoin has accelerated and a new swing low was printed at 53.5K , 200D MA has been breached

Will Monitor extremely closely if it either of the 3 scenario applies,

1) successfully defend the 200D MA

2) further waterfall decline

2) short stay below200D ma and develop a certain fail breakdown pattern

Join my paid subscription as I unpack and give you more contextual data to analyze and reveal if this pullback in cap-weighted indices is something you should be concerned about.

If you would like to know more about the risk parameters to establish high probability profitable trade, and subsequent response to next market development then join my Paid subscription

the following sections are for paid subscribers

Paid subscribers will get my thoughts on the latest update in the market as the situation/development unfolds. You will also get access to higher quality indicator ( money flow, AVWAP, cycles ) to get a better handle on the market, and triangulate your entry point at Buying/accumulating your 401K ETF product.

Join the subscription and leave your doubt behind if you want to avoid second guessing yourself on your Investment and trading decision. In today market, you need access to evidence based research and analysis to thrive and grow your account. Otherwise, you will be left guessing, 2nd guessing yourself pose a huge cost to your money, your time and lost Opportunity cost in the market.

Quality decision making is my middle name, which allows your money to work for you in the financial market, saving you tons of time and money while you are busy attending to your work and family commitments.