Daily market review Dec 3, 2024 ( Nasdaq 100 All time high, market breadth retreat , Sentiment is Bullish )

Lately, I've been grappling with a hefty dose of year-end performance anxiety because I am chasing extra gains to meet my lofty personal target (which, let's be honest, might seem like small potatoes to a crypto bro).

This year hasn't exactly been a walk in the park. According to JP Morgan, retail investors significantly underperformed against the market.

The game-changer for me this year has been the additional data and analytics I've woven into my investment/trading review framework. These tools have been invaluable during crunch time, helping me decide whether to raise/reduce stakes, hold, or fold. And guess what? You, dear reader, can also benefit from these insights in a simple, easy-to-digest format within the secret sauce section for subscribers.

The US stock market has been on a tear lately, with the Nasdaq and S&P 500 posting record closing highs.

JOLTS report posted a 7.74M with higher quite rate, beating streets expectation. Upcoming non-farm data ( or rather the revision to previous months figure ) will be closely watched by investors to gauge the strength of the job market.

Additionally, Powel upcoming speech on December 4th 1:45pm eastern time will be scrutinized for hints of rate pause or hike.

Now, let's dive into the market review section.

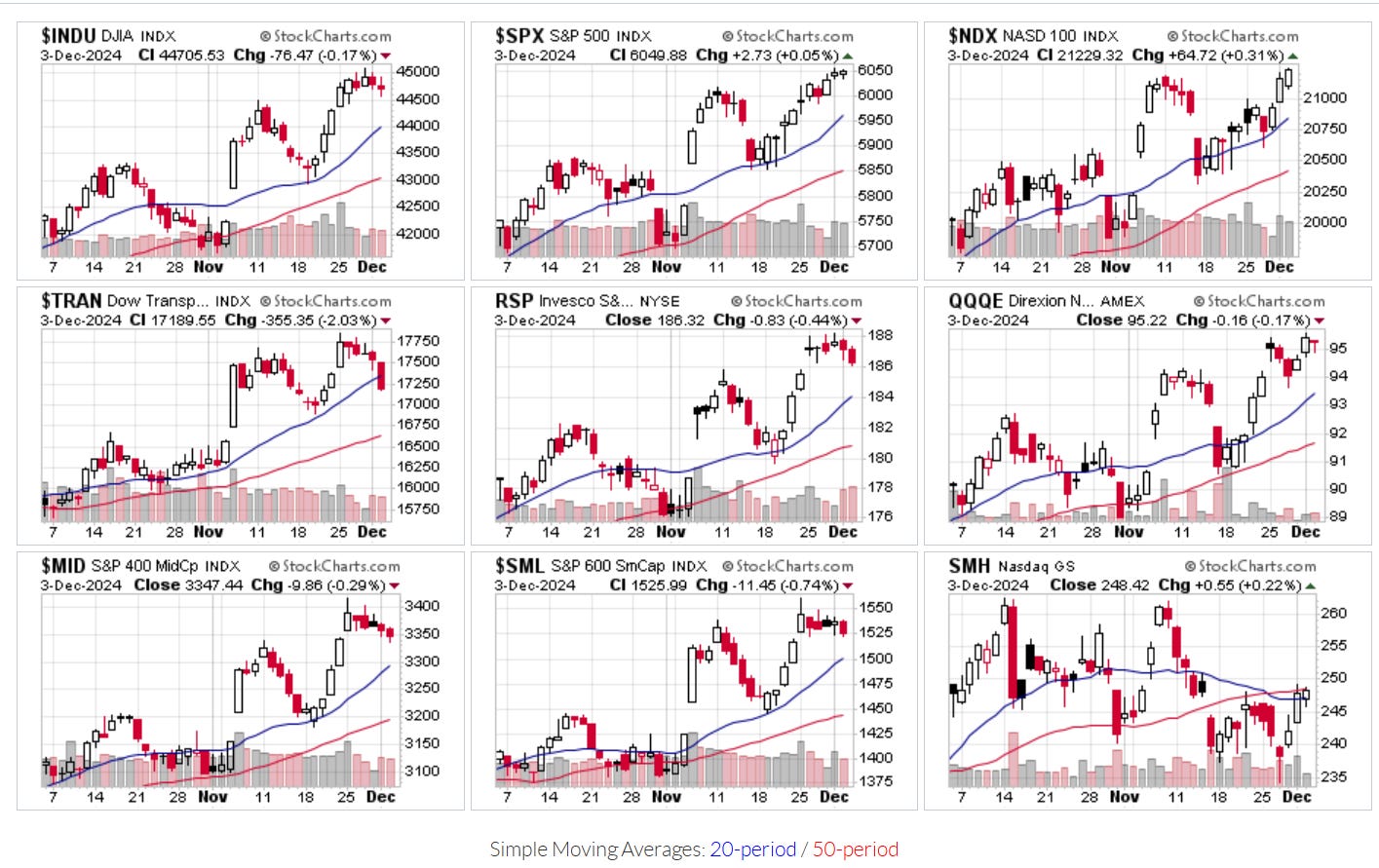

Broad market overview

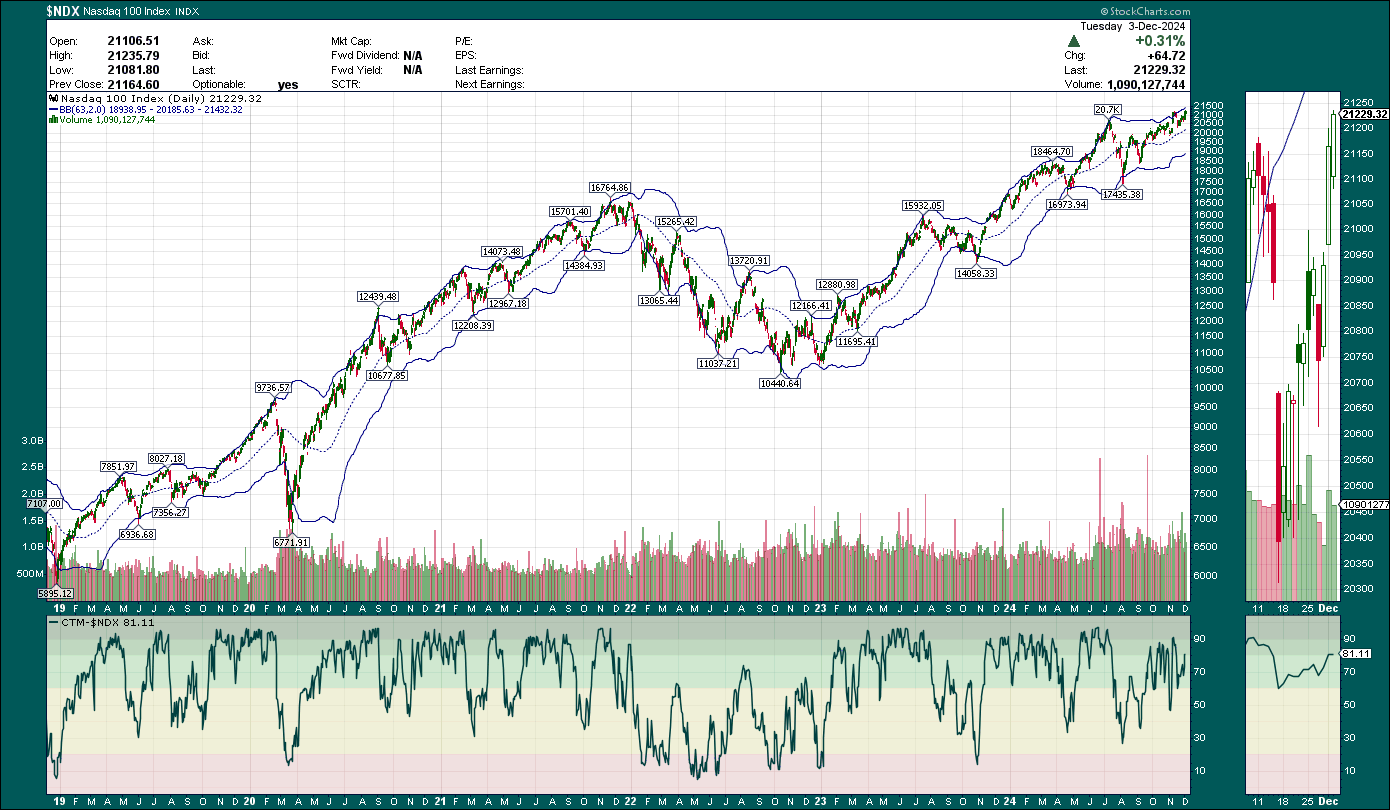

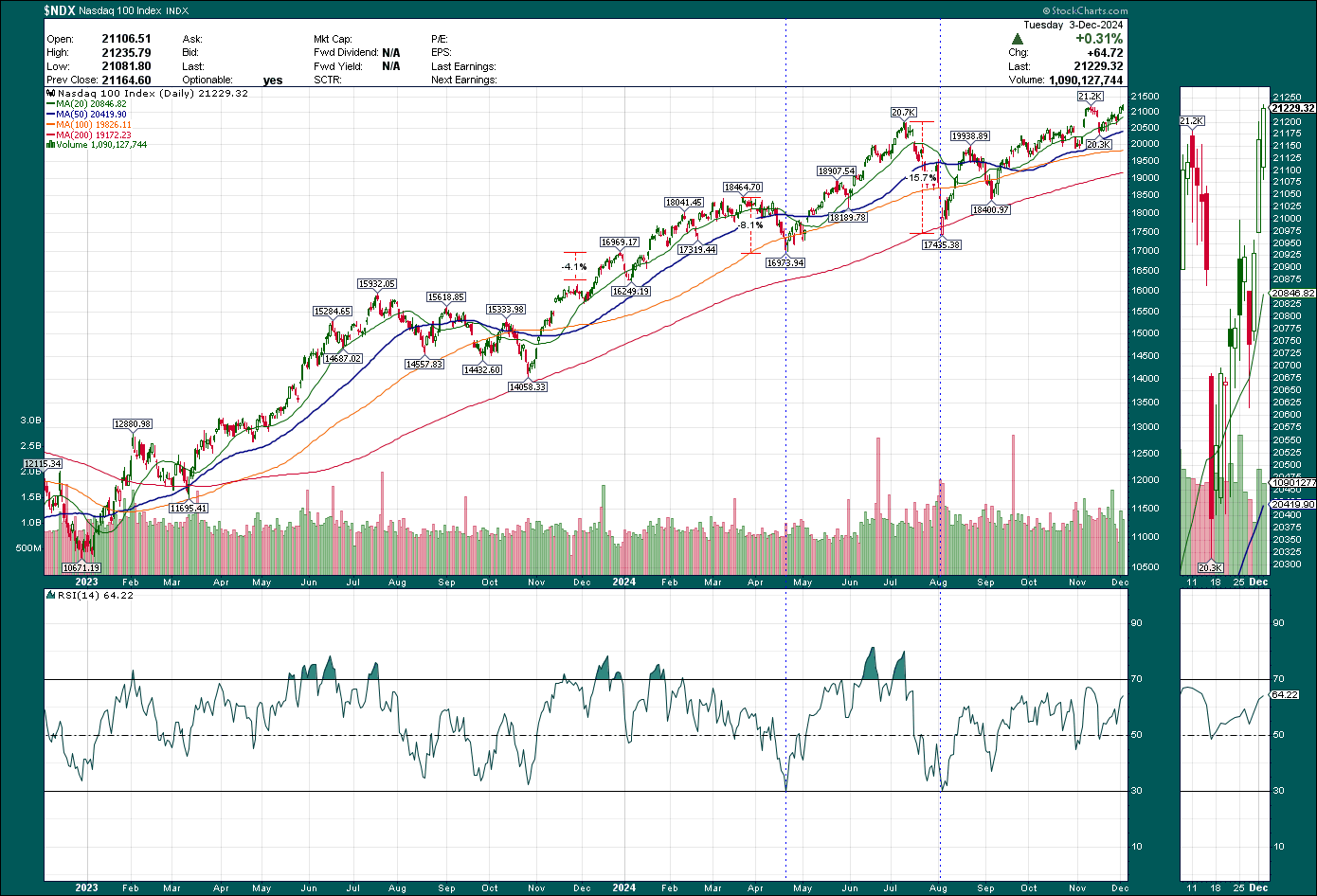

Nasdaq 100 made a record new ATH above 21.22K. Large Cap Weighted indices outperform small& mid cap, Equal-weighted counterpart

S&P 500 11 sectors overview

Discretionary, communications continue to eke out incremental gain recently, while Utility and Real estate, and staples larger retreat is a relief.

MOVE index

Move index is currently at 95.6, bond price implied volatility is expected to be around 9.56% per annum.

Lower MOVE points to (implied) lower bond market volatility going forward. Bond volatility moving lower translates into less haircut to bond, in which more liquidity can be extracted from the collateral pool.

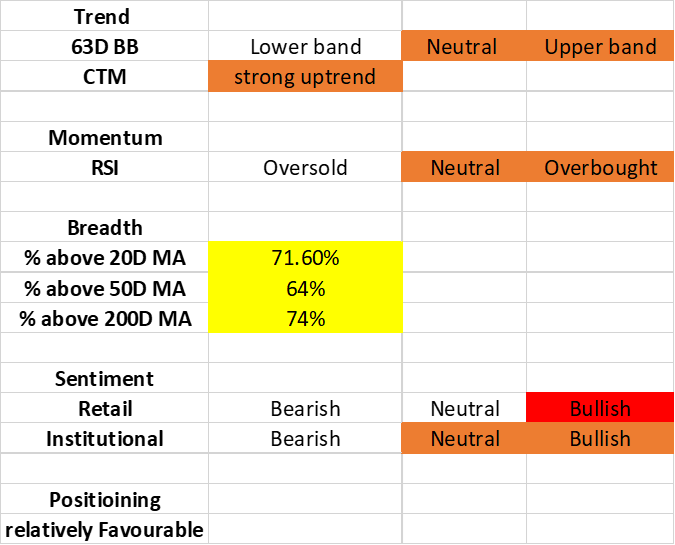

Summary of Market situation

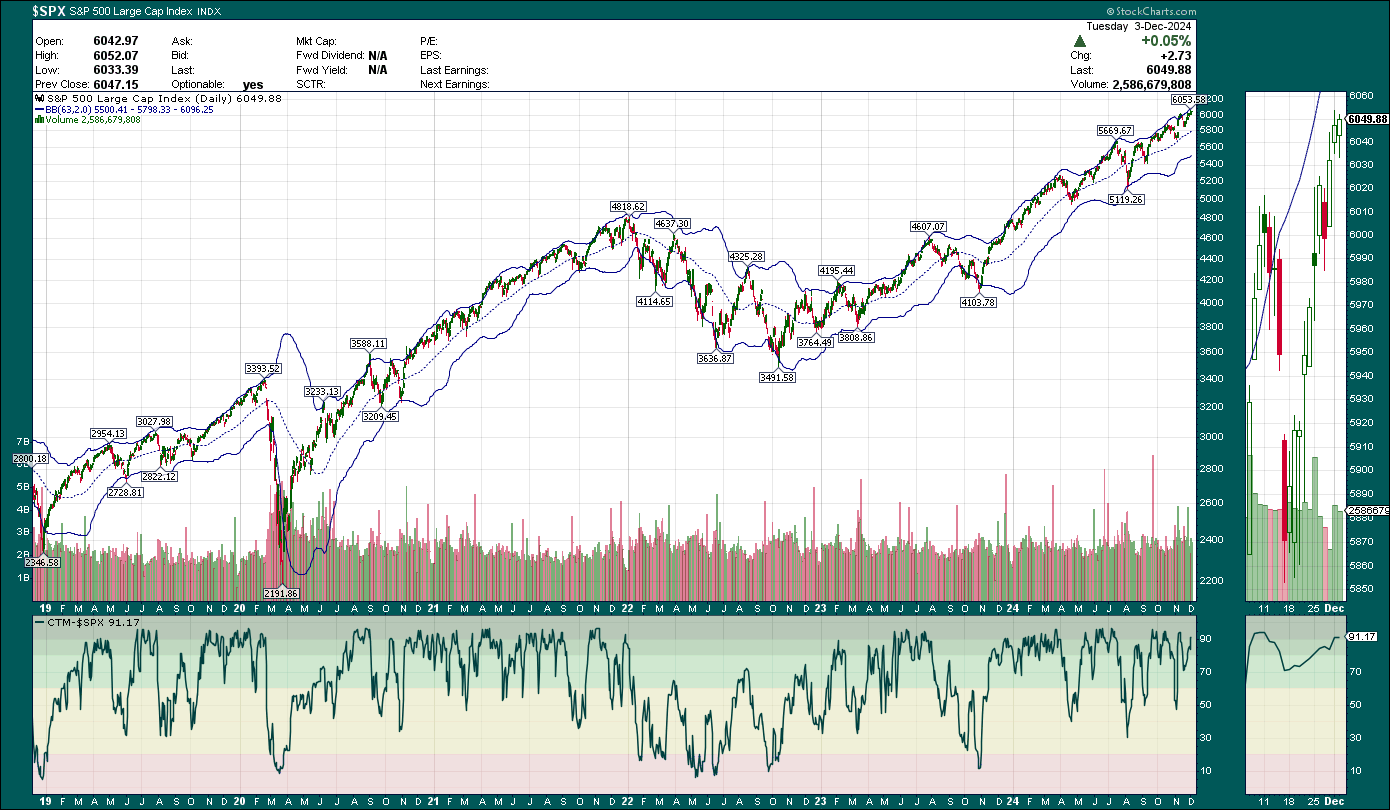

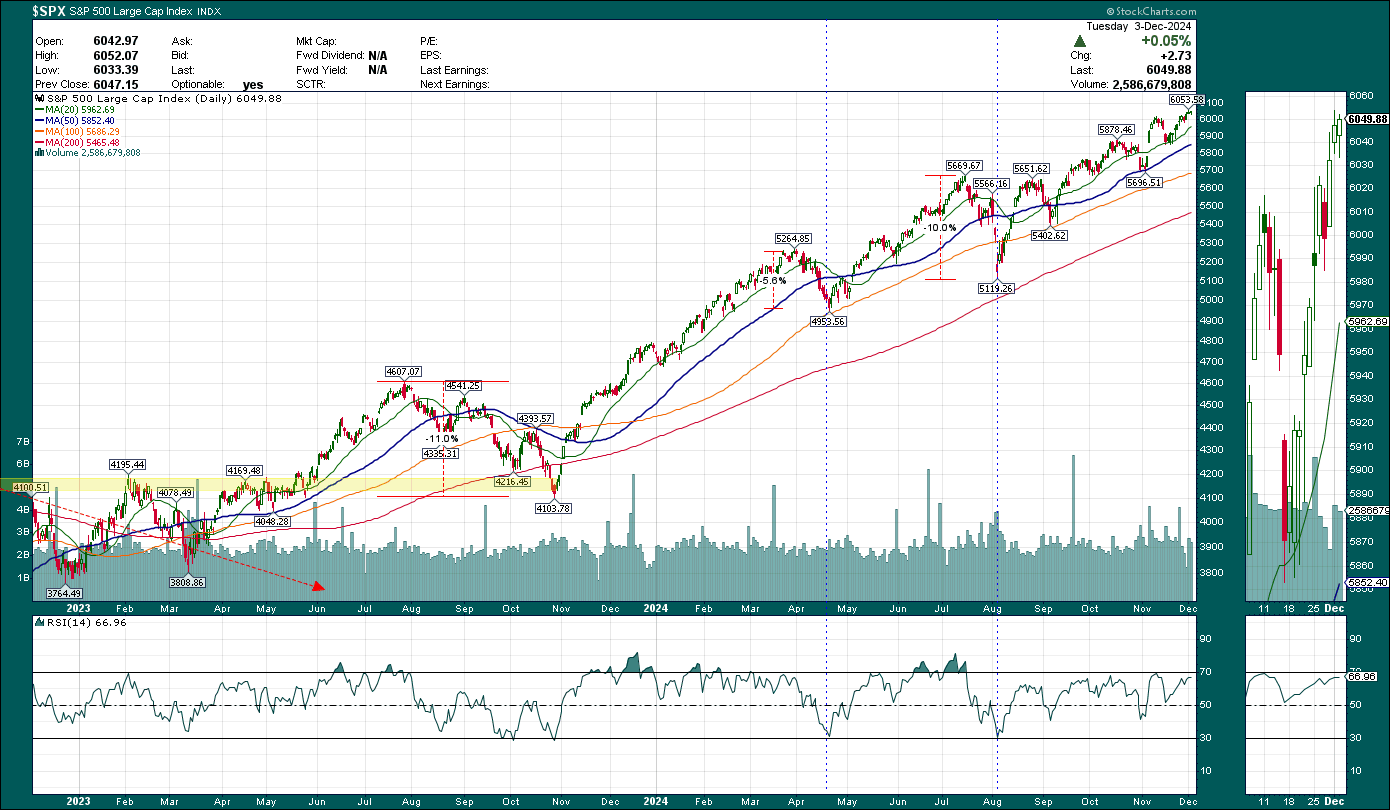

Trend and Momentum Section

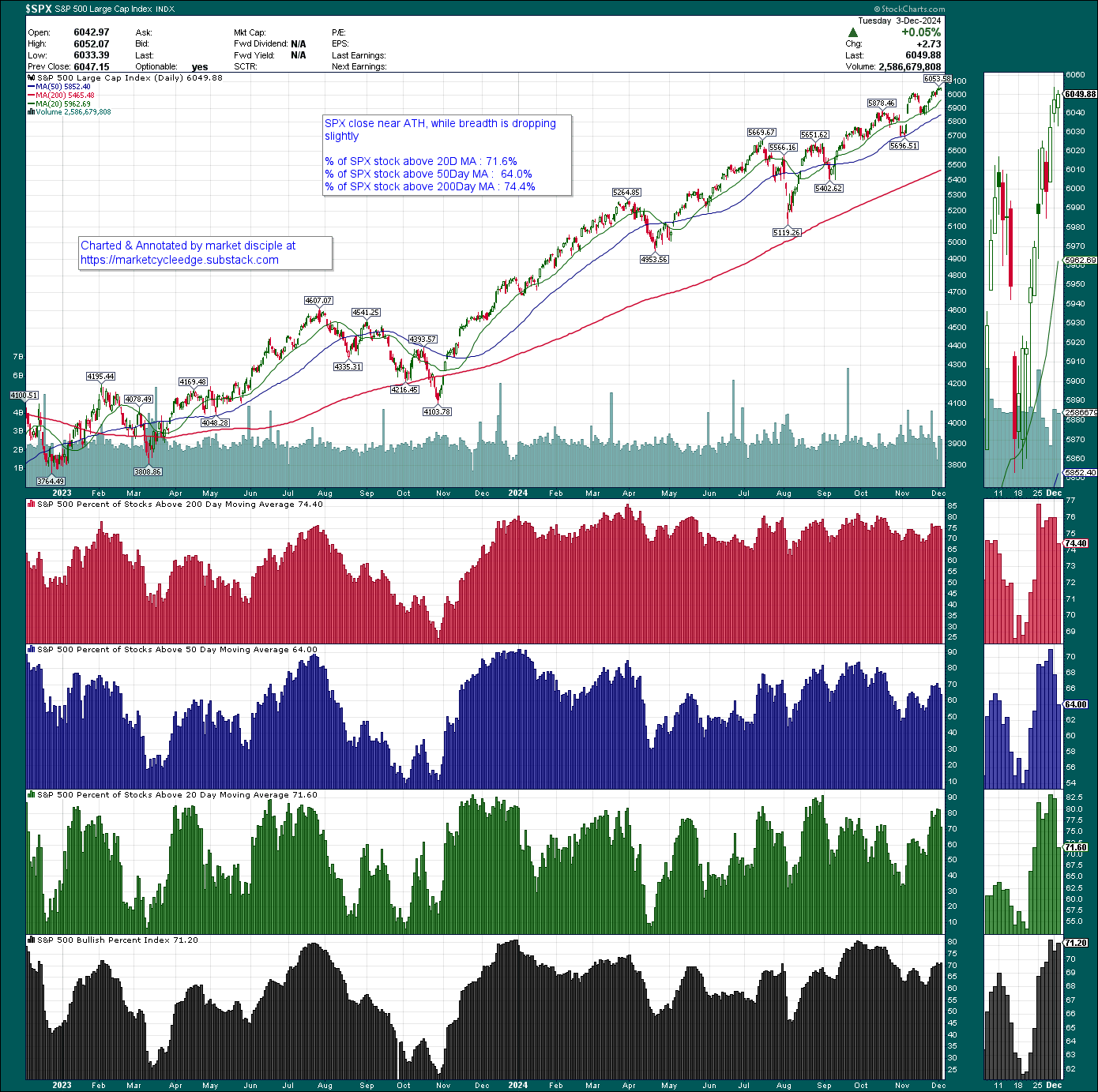

SPX

NDX

Market breadth section

% of SPX stocks above 20D 50D 200D moving average

SPX close near ATH while breadth drop slightly, breadth retreat is mainly caused by retracement of Industrial, financials outperformance around election, and retreat of defensive sectors, a good news so far.

% of SPX stock above 20D MA : 71.6%

% of SPX stock above 50Day MA : 64.0%

% of SPX stock above 200Day MA : 74.4%

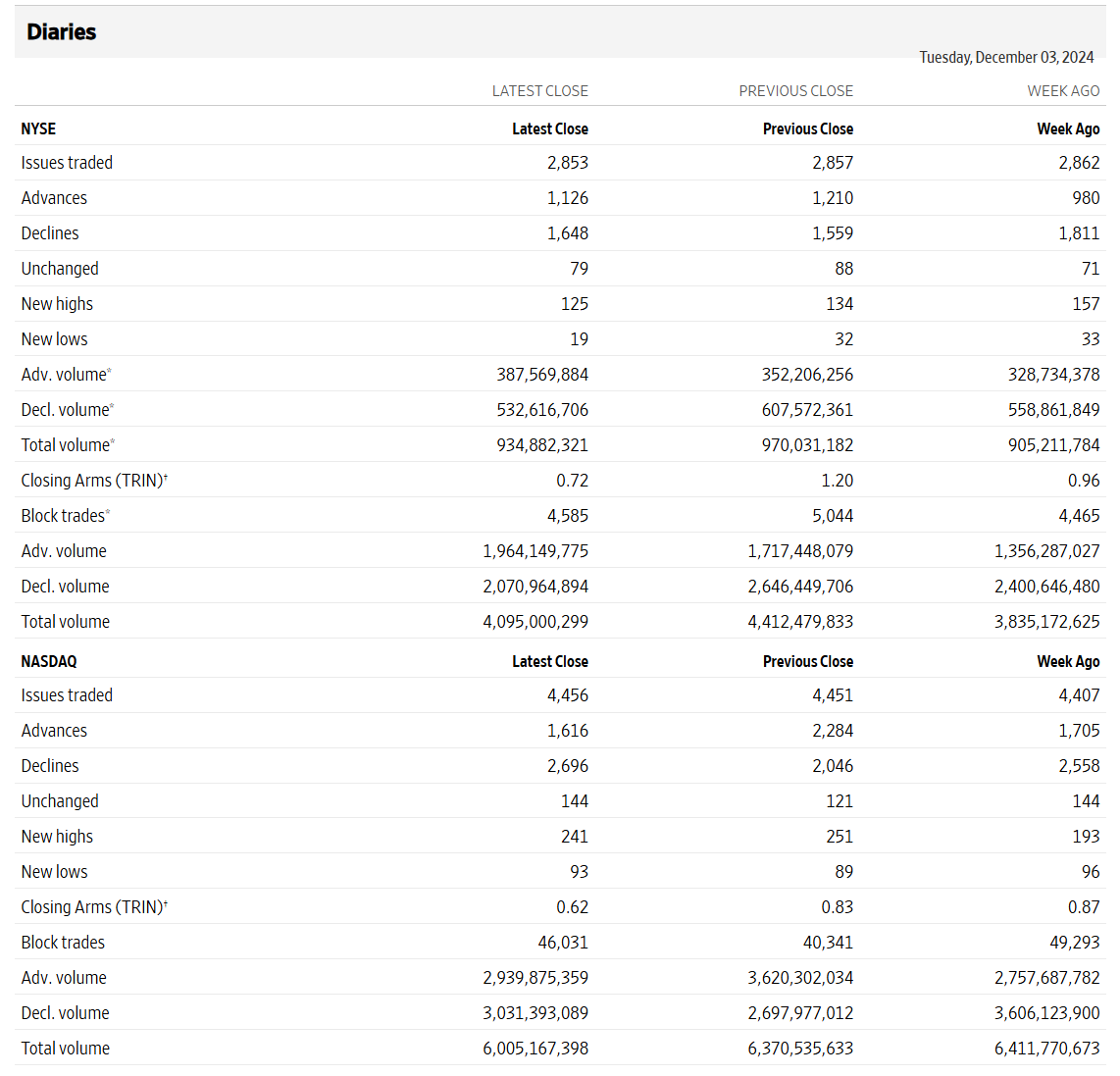

NYSE & Nasdaq market internals

There are more Decliner than Advancer, and at lower volume.

On Dec 3 2024 trading session,

1.46 to 1 NYSE Decliners to Advancer ratio (1648/1126 )

1.67 to 1 Nasdaq Decliners to Advancer ratio (2696/1616 )

Sentiment

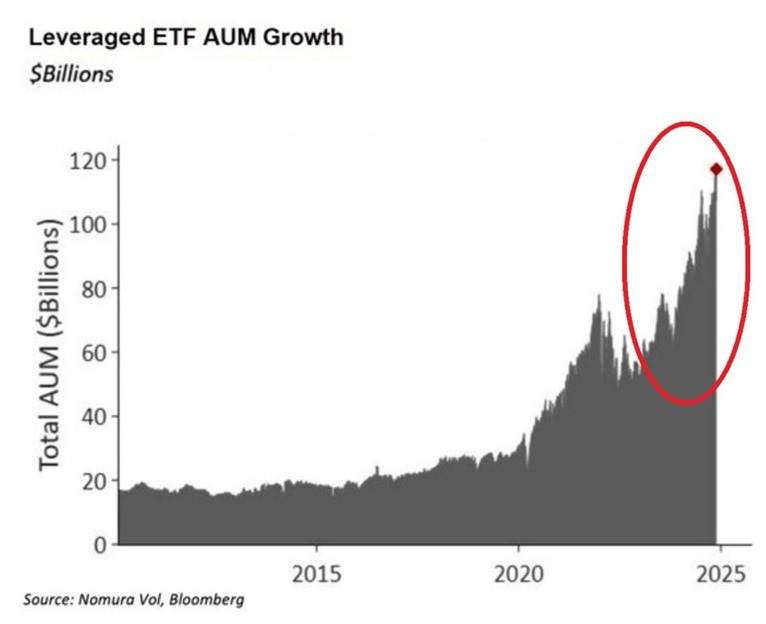

Sentiment is extremely bullish, bordering on Mania on the retail side, as evidence by the growth in Leverage ETF AUM

As for institutional side, a targeted and near term review on this in the subscriber section

Positioning

Positioning turn somewhat favourable.

Why is it favourable ? Unlock the latest positioning info and interpretation in subscribers section.

Upcoming Economic data release

There are several high profile data coming this week as well as fed speeches. What are the expected market volatility % for each of this data release ? Unlock the latest expected movement info in subscribers section.

Secret sauce for subscribers section

Unlock Exclusive Insights and Secure Your Financial Future!

Are you eager to:

1. Discover near-term opportunities vs. risks and know the right actions to take for your portfolio?

2. Access the "Secret Sauce" section that strengthens the resilience of your investment process, minimizing financial and mental strain during market drawdowns?

3. Expected market movement for the upcoming economic calendar ?

If so, join my Paid Subscription and elevate your financial game!

Why Invest in Our Paid Subscription?

For just $15 per month (a mere $0.50 per day) or $149 per year (less than $0.42 per day), you’ll gain:

🔍 Expert Analysis: In-depth analysis of market trends and actionable insights to stay ahead of the curve. 📈 Big Ideas: Multiple high-impact ideas per year to capitalize on the biggest shifts in the financial market. 🔑 Secret Sauce: Proven strategies and techniques to fortify your investment process, ensuring resilience and long-term growth. 💡 Knowledge & Empowerment: Empower yourself with the knowledge to make informed decisions and accelerate the growth of your savings and investment accounts.

Cost vs. Benefit

Imagine turning your daily coffee budget into a powerful investment strategy that drives your financial success. For less than the cost of a cup of coffee, you can access expert guidance and exclusive insights that have the potential to significantly boost your portfolio's performance.

Why Choose Our Service?

· Proven Results: Our subscribers have consistently outperformed the market, thanks to our timely and insightful advice.

· Comprehensive Support: We don’t just give you the "what" but also the "how" and "why," ensuring you understand every step of your investment journey.

· Community: Join a community of like-minded individuals who are committed to achieving financial independence and success.

Join Us Today!

Don’t miss out on the opportunity to transform your financial future. Subscribe now and start making smarter, more informed investment decisions.