Daily market review Apr 9 2025 (Face-ripping rally post Trump Tariff 90-day Pause )

With So many cross currents, the tariff – post liberation day “negotiation”, the recession call, the rotation, it culminates into an uncertainty that the investors have liquidated and stay in the sideline. ( retails and institutions alike )

In particular, foreign institutional investors are pulling funds from US equity markets and repatriating the money into their own countries, diversifying into other continents asset market. Or could it be non-discretionary, quantitative funds behind the selling or is it like what Trump said, that globalist is behind the market sell-off ? Surprisingly and as much as you dislike Trump, he is partially right in saying that Globalist is behind the sell-off in the market, because foreign institutional investors who has global asset exposure are shifting their asset mix ( pulling some of the funds away from US market, and putting some of it back into their domestic and non US market. )

We are in the headline, catalyst driven market, I don’t like being a headline trading/headline management, but partially we sort of have to, to survive in the current market. The most important things is to stalk your internal trendline, level, risk parameter.

Therefore I have revamped my process and is in a completely process routine from before, so takes a long while to get used to, reviewing chart , level ( as related to institutional money flow, options parameter and flow ). All this while watching news, policymaker talking point & their medium term policy plan, connecting the dot and gaming out various scenario while watching the charts ticks, figuring consistency & inconsistency of inter-market relationship. All this while trying to help out household chore, taking care of 2YO child, and keeping up with all of this without getting much sleep.

In the nearest term, the following trendline is all that matters for both SPX and NDX,

Lets dive into the market review section,

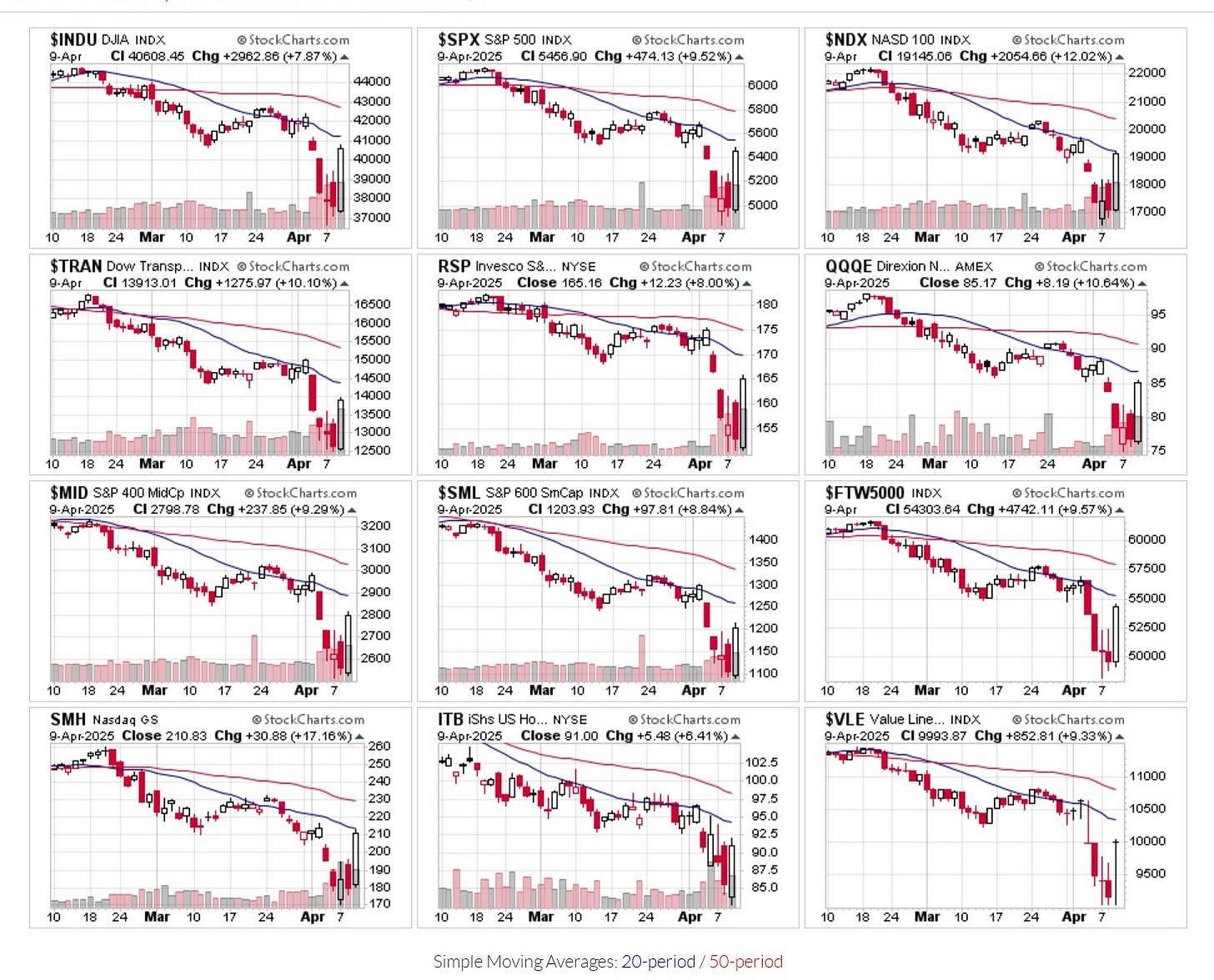

Broad market overview

Everything bounce with a giant greenbar regardless of cap, sector, enuf said.

S&P 500 11 sectors overview

Everything bounce with a giant greenbar regardless of cap, sector, enuf said.

MOVE index

Move index is currently at 128.83, bond price implied volatility is expected to be around 12.83% per annum.

Higher MOVE points to (implied) Higher bond market volatility going forward. Bond volatility moving higher translates into more haircut to bond, in which less liquidity can be extracted from the collateral pool.

Summary of Market situation

Trend and Momentum Section

SPX

NDX

Market breadth section

% of SPX stocks above 20D 50D 200D moving average

Both index and market breadth attempt to bounce violently.

NYSE & Nasdaq market internals

There are more Advancer than Decliner, and at higher volume.

On Apr 10 2025 session,

15.54 to 1 NYSE Advancer to Decliner ratio (2658/171 )

5.36 to 1 Nasdaq Advancer to Decliner ratio (3778/705 )

Positioning and Sentiment

Bearish on the retail side, how about institutional side ? pending for tonight release.

And in options market, it’s extremely bearish, super high demand for Put.

Disclaimer : The information presented here are for research and education purpose only, and does not constitute investment advice, trading recommendation, author shall not liable for any action taken by any individual/company with regards to the information presented here or any part of the website - https://marketcycleedge.substack.com/

The views expressed on this website represent the current, good faith views of the authors at the time of publication. Please be aware that these views are subject to change at any time and without notice of any kind. Marketcycleedge.substack.com and its author assumes no duty and does not undertake to update these views or any forward-looking statements, which are subject to numerous assumptions, risks, and uncertainties, which change over time. All material presented herein is believed to be reliable, but we cannot attest to its accuracy. The information contained herein (including historical prices or values) has been obtained from sources that marketcycleedge.substack.com and its author considers to be reliable; however, marketcycleedge.substack.com and its author makes no representation as to, or accepts any responsibility or liability for, the accuracy or completeness of the information contained herein, or any decision or action taken by you or any third party in reliance upon the data. All traders and investors are urged to check with Financial advisors before making any trading /investment decision.